Businesses in South Africa are fairly familiar with carbon tax by now, and as these taxes increase, it’s becoming more important for industrial operations to find methods of cutting carbon emissions. However, the emerging trend that companies should be taking more seriously is their carbon impact, a vital factor for all businesses to include into their sustainability strategies. If they do not, they are at risk of not only losing money as their operational costs start to soar, but they are likely to lose their competitive edge among potential partners and investors in the near future.

This is the warning from Tygue Theron, Head of Business Development at Energy Partners Sustainability – a division of Energy Partners and part of the PSG group of companies – who says that large local companies’ environmental, social, and governance (ESG) strategies are coming under increased scrutiny by stakeholders. “We’ve increasingly seen corporates being called out in recent years over their low ESG scores. This is due to the negative impact these businesses are having on world around them – either from an environmental, social or governance perspective. Knowing this, businesses need to understand that their sustainability strategies should be about more than simply keeping operational costs low.”

Theron goes on to note that the international financial reporting structure (IFRS), which every publicly traded company must adhere to, has made it a requirement to disclose non-financial climate-related information about business operations. “In short, public companies are forced to take an in-depth look at their environmental impact and the resources that they use and make a change if they want to be perceived as viable investments.”

Interestingly, he adds that investors are currently hungry for companies that take ESG responsibility seriously, so a well-structured sustainability plan will give a company a significant boost in its investment appeal. “Even if a company hasn’t made substantial strides in curbing its carbon impact yet, committing to a sustainability strategy that takes the business risks into account and shows these will be addressed can be enough to send the potential for investment through the roof.”

In addition, corporates can also enable access to better interest rates on business loans. Sustainability-linked finance is a massive benefit in terms of lowering the cost of capital for businesses that have a forward-thinking vision.

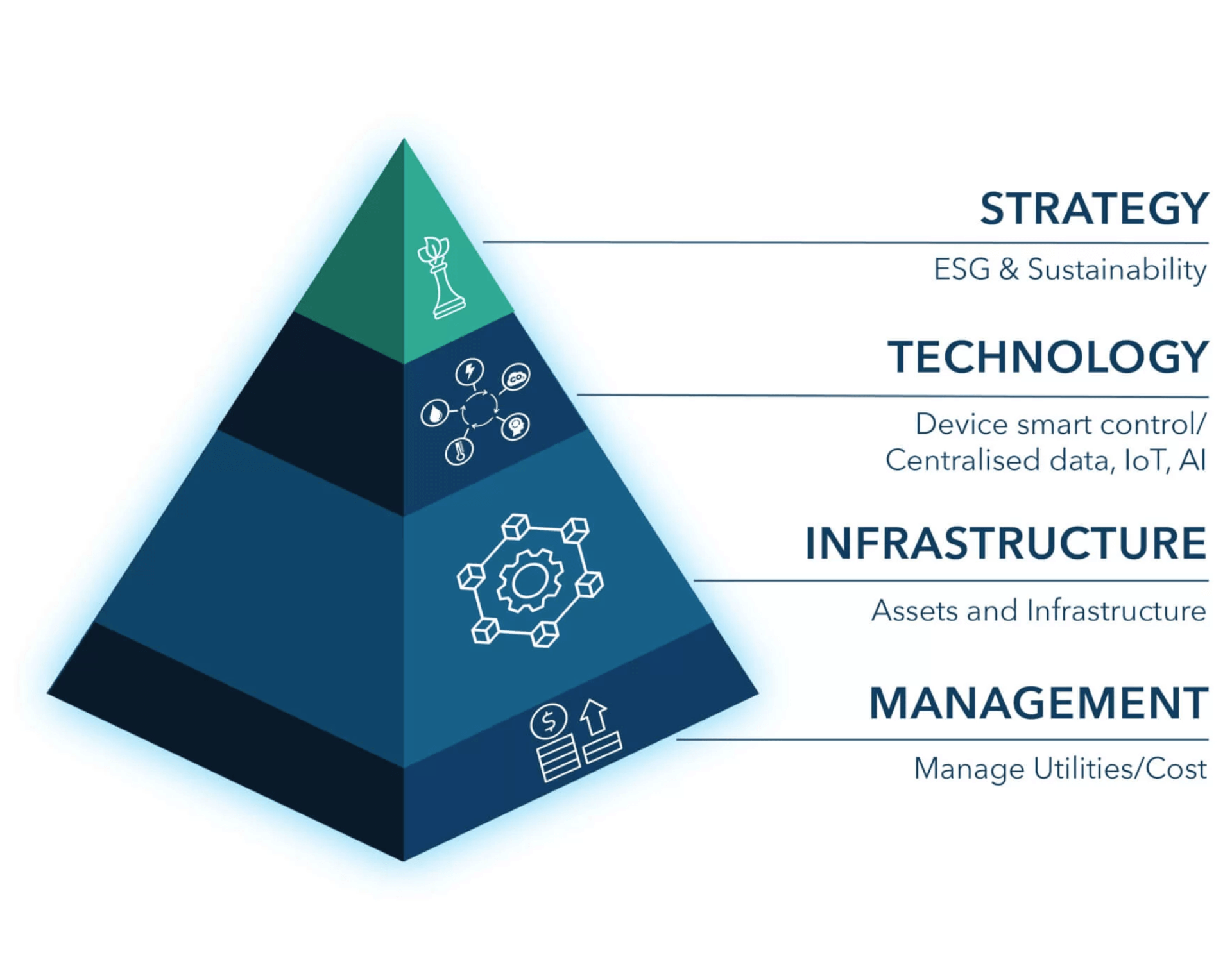

However, Theron also points to one major possible challenge facing companies looking to commit to more investor friendly ESG strategies. “There are so many frameworks to base a sustainability strategy on, and a fair number of them will have no effect on an ESG score. We often see clients pursue the wrong priorities and adopt the incorrect frameworks, which is why we have started specialising in ESG consulting. We are uniquely positioned to set the strategy and execute it with a strong implementation layer within our team, focusing on the ultimate goal of helping clients ensure that they implement the correct frameworks, use their time effectively and get the right results with their strategies.”

Ultimately, Theron says that sustainability strategies have become incredibly complex and specialised. “It is more important than ever to have the right strategy in place. In order to develop an impactful strategy that allows the company to make the right impact for years to come, it’s essential to partner with specialist that has a proven track record and can hold the business accountable to its plan.”